TL;DR

Tendering gives Australian businesses access to contracts worth $500K to $50M+, but each bid costs $10K to $150K with no guarantee of success.

Average win rates sit between 15-25%, dropping to just 5-12% for first-timers.

This guide is for business owners weighing whether government and corporate tenders are worth the investment. You’ll learn the 12 key advantages, 10 critical risks, and a practical ROI framework to make smarter bid decisions.

Key Takeaways

- Calculate Breakeven Win Rate: Bid costs ($40K) vs. contract margins ($200K) require a 20%+ win rate to profit. Track this diligently.

- Limit Active Bids (3-5 max): Focus on quality. More bids dilute effort and risk burnout (e.g., 15 mediocre bids vs. 4 excellent ones).

- Invest in Panel Arrangements: Panel qualification opens multiple long-term, low-cost opportunities (3-5 years).

- Request Loss Debriefs: Free feedback from evaluators identifies specific improvement areas that compound over time.

- Build Compliance Early: ISO, documented processes, and insurance take months. Avoid last-minute scramble.

- Start with Subcontracting: Partner with established firms to build government track record before bidding as prime.

- Track Incumbent Status: If the current supplier is embedded and performing well, your chance is low. A “no-bid” is often the best decision.

Introduction

Here’s a number that might surprise you: Australian businesses spend an average of $47,000 per tender response, yet only 20% of bids succeed. That’s $188,000 in bid costs for every contract won.

Picture this scenario. Your Melbourne-based IT firm spots a $2.3M government contract on AusTender. The scope matches your capabilities perfectly. But the 6-week response deadline means pulling three senior staff off billable work. You’ll spend $35K on the bid. And you’re competing against 12 other suppliers.

Sound familiar?

By the end of this guide, you’ll know exactly when to pursue tenders—and when to walk away. You’ll understand the true costs, realistic win rates, and ROI calculations that separate profitable tendering strategies from expensive mistakes.

Here’s what you need to know:

Core Advantages of Tendering (6 Key Benefits)

Tendering isn’t all risk. Done right, it builds businesses. Here are the genuine upsides worth considering.

Access to High-Value Contracts

Government and large corporate contracts dwarf typical private sector deals. A single tender win can transform your revenue profile overnight.

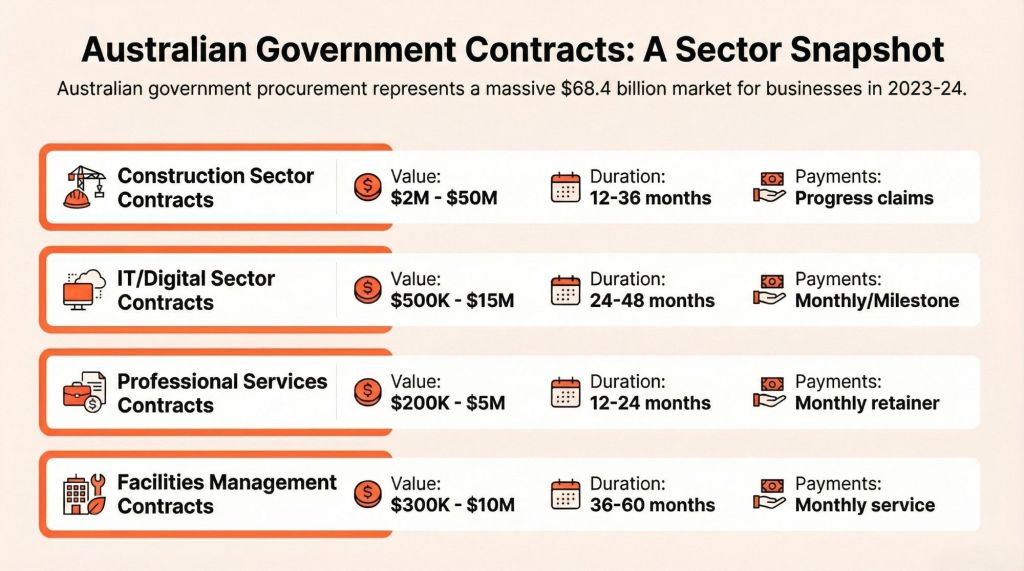

Here’s what different sectors offer:

| Sector | Contract Value (AUD) | Duration | Payment Terms |

| Construction | $2M-$50M | 12-36 months | Progress claims |

| IT/Digital | $500K-$15M | 24-48 months | Monthly/milestone |

| Professional Services | $200K-$5M | 12-24 months | Monthly retainer |

| Facilities Management | $300K-$10M | 36-60 months | Monthly service |

Case in point: A Brisbane engineering consultancy I worked with won their first Queensland Rail tender worth $1.8M. That single contract represented 40% of their annual revenue and employed 6 additional staff for 3 years.

The Australian Bureau of Statistics reports government procurement totalled $68.4 billion in 2023-24. That’s a massive addressable market.

Market Positioning

Winning government work changes how the market perceives your business. The “approved government supplier” badge carries weight.

Here’s where it gets interesting: According to research from Procurement Australasia, win rates improve by 40-60% after securing your first government contract. Why? Proven track record matters. Evaluators favour demonstrated capability over promises.

You also gain access to centralised portals:

- AusTender for Commonwealth opportunities

- QTenders for Queensland

- eTendering NSW for New South Wales

These platforms let you set alerts, track competitors, and build market intelligence.

Capability Development

The tender process itself builds organisational muscle. Sounds counterintuitive? It’s not.

Writing competitive proposals forces you to:

- Articulate your value proposition clearly

- Document processes and methodologies

- Quantify past performance with evidence

- Build case studies with measurable outcomes

Many suppliers report that their proposal writing skills transfer directly to sales pitches and client presentations.

You’ll also develop compliance systems. ISO certifications, WHS documentation, quality management frameworks—these become assets for all client work, not just government contracts.

Revenue Stability

Government contracts typically run 12-60 months. That’s predictability most businesses dream about.

The numbers support this advantage:

- 65% of government contracts include extension options

- Panel arrangements span 3-5 years

- Standing offers provide ongoing work streams

A Sydney facilities management company told me their 4-year NSW Health contract let them plan three years ahead. They invested in training, hired permanent staff, and expanded service offerings—all because revenue certainty reduced their risk profile.

Industry Visibility

Tender briefings are networking goldmines. You’re in a room with potential partners, subcontractors, and even friendly competitors.

The benefits compound:

- Joint venture opportunities emerge from briefing conversations

- Subcontractor relationships form before bids are written

- Market intelligence flows freely at pre-tender meetings

I’ve seen businesses win more work from briefing connections than from the actual tenders they attended.

Continuous Improvement

Here’s something most suppliers overlook: debriefing feedback is free consulting.

Government evaluators will tell you exactly why you lost. They’ll identify weaknesses in your methodology, gaps in your evidence, and pricing problems. This feedback costs nothing and improves every future bid.

What does this mean for you? Each unsuccessful tender makes the next one stronger—if you’re paying attention.

Critical Disadvantages of Tendering (10 Key Risks)

Now for the uncomfortable truths. Tendering carries genuine risks that sink unprepared businesses.

High Upfront Costs (No Guarantee)

Let me show you what tenders actually cost:

| Tender Complexity | Contract Value | Typical Bid Cost | Resources Required |

| Simple | $50K-$500K | $10K-$15K | 2 staff, 1 week |

| Medium | $500K-$5M | $25K-$50K | 3-4 staff, 2-3 weeks |

| Complex | $5M+ | $80K-$150K+ | 5-8 staff, 4-8 weeks |

Add these hidden costs:

- Legal contract reviews: $5K-$15K

- Insurance certificates: $2K-$8K

- Security clearances: $500-$2,000 per person

- Site visits and travel: $1K-$5K

The catch? You spend this money with zero guarantee of return. A 20% win rate means losing $40K-$75K on every successful $50K-$150K contract pursuit.

Time-Intensive Process

Realistic tender timelines look like this:

Week 1-2

- Bid/no-bid decision: 2-3 days

- Registration and document download: 1-2 days

- Clarification questions submitted: Day 5

- Research and information gathering: Days 6-14

Week 3-4

- Response drafting: Full team engaged

- Internal reviews and revisions: Senior staff

- Final compilation and formatting: Last 2 days

Week 5-6 (if shortlisted)

- Presentation preparation: 3-5 days

- Interview or demonstration: Half-day minimum

Plot twist: Your competitors are doing this same work. Those 6 weeks of effort compete against 8-15 other submissions doing exactly the same thing.

Low Win Rates

These numbers sting:

| Supplier Type | Average Win Rate |

| First-time tenderers | 5-12% |

| Industry average | 15-25% |

| Experienced suppliers | 25-40% |

| Incumbents | 45-65% |

That incumbent advantage is brutal. Existing suppliers win nearly half their re-tenders. New entrants win one in ten.

A Perth professional services firm shared their first-year results: 14 bids submitted, $89,000 in direct costs, 1 contract won worth $340,000. Profitable? Barely. Sustainable? Only because they improved to 28% win rate by year three.

Strict Compliance Requirements

Non-conforming bids get disqualified. Full stop.

Common compliance failures include:

- Missing mandatory documents

- Incomplete insurance coverage

- Insufficient financial capacity

- Late submission (even by seconds)

- Word count exceeded

- Wrong file format

Insurance requirements alone can disqualify smaller suppliers:

| Insurance Type | Typical Requirement |

| Public Liability | $10M-$20M |

| Professional Indemnity | $5M-$20M |

| Workers Compensation | Statutory compliance |

| Cyber Insurance | $1M-$5M (increasingly common) |

Financial capacity tests typically require turnover of 2-3 times the annual contract value. A $2M contract might need $4M-$6M in annual revenue to qualify.

Price-Driven Competition

Government procurement optimises for value—which often means lowest price.

The surprising part? According to Victorian Government Purchasing Board analysis, price weighting accounts for 40-60% of evaluation criteria in 67% of tenders. Lowest compliant bid wins 60-70% of the time.

This compresses margins. Suppliers report margins 15-25% lower on government work compared to private sector equivalents.

A Melbourne construction firm analysed their portfolio: private projects averaged 18% margin, government projects averaged 11%. Same work, different buyers.

Resource Diversion

Senior staff involvement isn’t optional in tendering. Evaluators want to see the people who’ll actually deliver.

This creates tension:

- Your best project managers are writing bids instead of managing projects

- Technical leads spend days on methodology documents

- Directors attend briefings and presentations

The opportunity cost is real. Every hour on tender responses is an hour not spent on billable work or business development.

Cash Flow Challenges

Government payment terms strain working capital:

| Cash Flow Impact | Typical Terms |

| Payment cycles | 30-45 days from invoice |

| Retention held | 5-10% for 12-24 months |

| Bank guarantees | $50K-$500K+ tied up |

| Mobilisation costs | Self-funded for 60-90 days |

A $3M contract with 5% retention means $150,000 held for up to two years. Bank guarantees lock up capital that could fund growth elsewhere.

Rigid Contract Terms

Government contracts aren’t negotiable. You accept their terms or don’t bid.

Standard clauses include:

- Unlimited liability for certain breaches

- Liquidated damages for delays

- Termination for convenience provisions

- IP assignment requirements

- Audit rights extending years post-completion

In my experience, these terms would be heavily negotiated in private sector deals. Government? Take it or leave it.

The Cost-Plus Trap

Low-ball bids create a dangerous cycle. Win on price, then scramble to recover costs through variations.

Here’s the thing: this strategy damages relationships. Agencies track variation histories. Suppliers known for aggressive variation claims get scored down on future bids.

Some contracts have seen engineering changes double initial values. The relationship deterioration makes re-tendering almost impossible.

Incumbent Advantage

New entrants face structural disadvantages:

- Information asymmetry: Incumbents know real costs, agency preferences, and stakeholder priorities

- Relationship capital: Years of face-time with decision-makers

- Performance evidence: Documented track record on the actual work

- Transition risk: Agencies fear disruption from supplier changes

That 45-65% incumbent win rate versus 15% for newcomers reflects these realities. Breaking in requires either dramatically superior capability or significantly lower pricing—neither sustainable long-term.

The Bottom Line

Tendering offers genuine opportunity—$500K to $50M contracts, multi-year revenue stability, and market positioning that compounds over time. But the costs are real: $10K-$150K per bid, 4-8 weeks of senior staff time, and win rates that hover around 20%.

Three numbers should guide your decision:

- Your realistic win rate (track it honestly)

- Your true bid costs (include everything)

- Your breakeven calculation (costs ÷ margin × win rate)

Here’s your next move: Before pursuing another tender, run those three calculations on your last 10 bids. If the maths doesn’t work, refine your bid/no-bid criteria. If it does, double down on opportunities matching your winning profile.

Successful tendering isn’t about bidding more. It’s about bidding smarter.

FAQs

What is the average cost to prepare a tender in Australia?

Tender preparation costs range from $10,000 for simple responses ($50K-$500K contracts) to $150,000+ for complex bids ($5M+ contracts). These figures include staff time, legal reviews, insurance documentation, and site visits. Most mid-market tenders ($500K-$5M) cost $25,000-$50,000 to pursue.

What is a good tender win rate?

Industry average win rates sit between 15-25%. First-time tenderers typically achieve 5-12%, while experienced suppliers reach 25-40%. Incumbents win 45-65% of re-tenders. If your win rate falls below 15%, review your bid/no-bid criteria and response quality.

How long does the tender process take in Australia?

Standard tender response periods run 4-6 weeks from advertisement to submission. Add 2-4 weeks for evaluation, 1-2 weeks for shortlisting activities, and 2-4 weeks for contract negotiation. Total timeline from tender release to contract execution typically spans 10-16 weeks.

What are government procurement thresholds in Australia?

Commonwealth threshold is $200,000 for open tender requirements. States vary: NSW $150,000, Victoria varies by procurement category, Queensland $188,000, WA $250,000, SA $220,000. Below these limits, agencies can use limited tender or direct sourcing approaches.

Is tendering worth it for small businesses?

Tendering can work for small businesses targeting contracts under $500K where competition is less intense. Start with Request for Quote opportunities requiring simpler responses. Build track record through subcontracting. Expect 18-24 months before achieving sustainable win rates. Budget $30,000-$50,000 for first-year tender investment.

What disqualifies a tender submission?

Common disqualifications include late submission (even seconds count), missing mandatory documents, insufficient insurance coverage, inadequate financial capacity, exceeding word limits, incorrect file formats, and failure to address mandatory criteria. Always use the compliance checklist before submitting.

How can I improve my tender win rate?

Focus on fewer, better-qualified opportunities. Invest in professional bid writing. Request and act on debriefing feedback. Build relationships through industry briefings. Develop case studies with quantified outcomes. Consider partnering with complementary firms to strengthen capability gaps.

What insurance do I need for government tenders?

Typical requirements include Public Liability ($10M-$20M), Professional Indemnity ($5M-$20M), Workers Compensation (statutory), and increasingly Cyber Insurance ($1M-$5M). Requirements vary by contract type and risk profile. Some tenders specify exact coverage levels as mandatory compliance items.