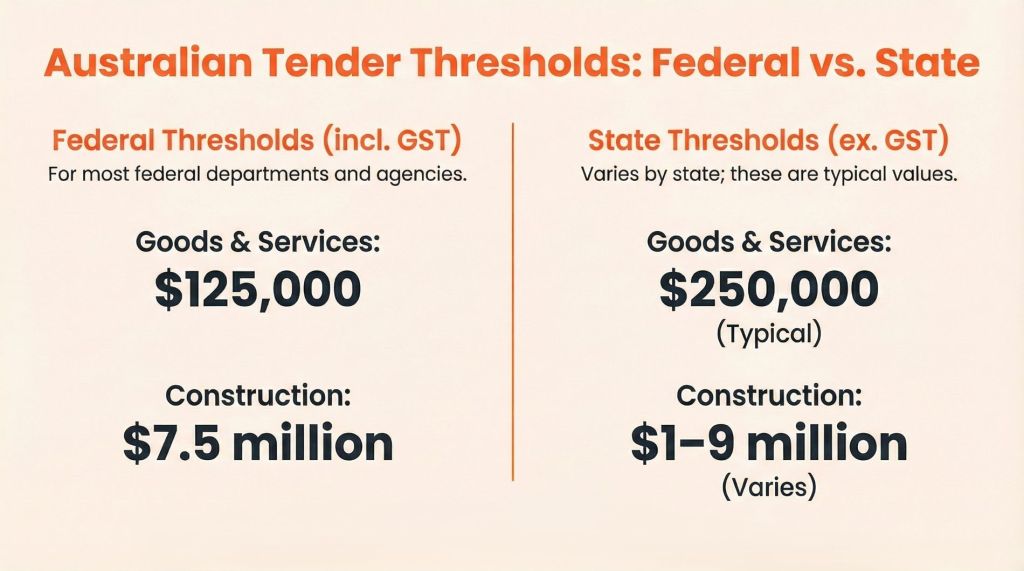

TL;DR: Tender thresholds determine when government agencies must conduct formal, competitive procurement. As of November 2025, the federal threshold for goods and services increased to $125,000 including GST, while construction remains at $7.5 million.

State thresholds generally sit around $250,000 for goods and services, with construction thresholds between $1 million and $9 million.

Local councils typically use thresholds around $250,000. Below these values, agencies can use simpler methods such as direct approaches or quotes, with federal rules now prioritising Australian businesses for below-threshold contracts.

Key Takeaways:

- Federal threshold for goods and services: $125,000 (incl. GST)

- Federal construction threshold: $7.5 million (incl. GST)

- Most states: $250,000 (ex GST) for goods and services

- Local councils: generally around $250,000

- Below-threshold federal contracts now prioritise Australian businesses

- GST treatment differs: federal thresholds include GST; most states exclude it

- Agencies must aggregate related purchases when assessing thresholds

What Are Tender Thresholds and Why Do They Matter?

Here’s the thing: not every government purchase requires a full-blown tender process.

A tender threshold is simply the dollar amount that triggers formal competitive tendering requirements.

Below that figure, agencies can use simpler methods like requesting quotes or approaching suppliers directly. Above it, they must open the opportunity to the broader market.

So why do these thresholds exist?

Three reasons drive the system:

- Transparency — Public money demands public accountability

- Value for money — Competition generally delivers better outcomes for taxpayers

- Fair access — Businesses deserve equal opportunity to compete for government work

The catch? Thresholds differ dramatically depending on who’s buying.

Federal agencies follow the Commonwealth Procurement Rules. State governments have their own frameworks. And local councils operate under separate legislation again.

This patchwork creates confusion. A $200,000 contract might require a public tender for one agency but not another—even in the same state.

Let’s break down exactly where these lines fall.

Australian Government Tender Thresholds (Federal — November 2025)

The Commonwealth Procurement Rules (CPRs) govern all federal government purchasing. These rules underwent their most significant overhaul in nearly a decade when updated CPRs took effect on 17 November 2025.

The headline change? A 56% increase to the general procurement threshold.

Current Federal Procurement Thresholds

| Procurement Type | Threshold (incl. GST) | When Competitive Tender Required |

| General goods & services (NCEs) | $125,000 | At or above threshold |

| Construction services | $7.5 million | At or above threshold |

| Prescribed corporate Commonwealth entities | $400,000 | At or above threshold |

| National security procurements | $4 million / Exempt | Case dependent |

NCEs = Non-corporate Commonwealth entities (most federal departments and agencies)

What is the tender threshold for Australian Government contracts? For most federal purchases of goods and services, agencies must conduct an open tender when the contract value reaches $125,000 (including GST). Construction services have a much higher bar at $7.5 million, reflecting the complexity and scale typical of building projects.

November 2025 CPR Changes: What’s New?

The November 2025 reforms represent the first increase to the non-construction threshold in 20 years. But the threshold bump is just one piece of a broader overhaul.

Key changes include:

- Threshold increase — From $80,000 to $125,000 for non-construction procurement

- Australian business priority — Below-threshold contracts now prioritise Australian suppliers

- SME access — Small and medium enterprises get preferential treatment on key government panels

- Ethical conduct — Value for money assessments must now consider suppliers’ ethical practices

- Clearer negotiation rules — New guidance on when and how agencies can negotiate with tenderers

When did the Commonwealth procurement threshold increase? The updated Commonwealth Procurement Rules took effect on 17 November 2025, raising the general threshold from $80,000 to $125,000 (GST inclusive).

These changes aim to reduce red tape for smaller purchases while channelling more government spending toward Australian businesses.

Division 1 vs Division 2 Rules Explained

The CPRs split into two divisions, and understanding this structure matters for suppliers.

Division 1 applies to every Commonwealth procurement, regardless of value. These are the baseline rules covering:

- Achieving value for money

- Encouraging competition

- Conducting ethical procurement

- Maintaining accountability

Division 2 kicks in only when procurement hits or exceeds the threshold. These additional rules require:

- Open approaches to market (public tenders)

- Minimum advertising periods

- Specific documentation requirements

- Debriefing obligations for unsuccessful tenderers

Here’s what this means for you: even contracts below $125,000 must still achieve value for money and follow ethical practices. The threshold simply determines whether the opportunity gets publicly advertised.

State and Territory Government Tender Thresholds

Each state and territory sets its own procurement thresholds. These apply to state government agencies—not local councils, which operate under separate rules.

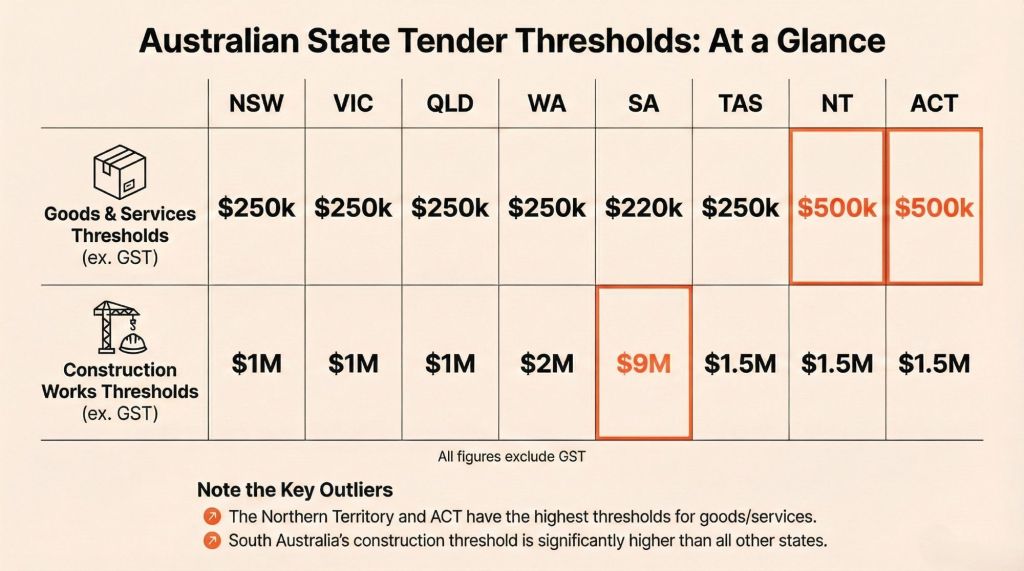

Most jurisdictions align their goods and services threshold around $250,000, but construction thresholds vary wildly.

State-by-State Threshold Comparison Table (2025)

| State/Territory | Goods & Services (ex GST) | Construction Works (ex GST) |

| New South Wales | $250,000 | $1 million |

| Victoria | $250,000 | $1 million |

| Queensland | $250,000 | $1 million |

| Western Australia | $250,000 | $2 million |

| South Australia | $220,000 | $9 million |

| Tasmania | $250,000 | $1.5 million |

| Northern Territory | $500,000 | $1.5 million |

| Australian Capital Territory | $500,000 | $1.5 million |

Note: Thresholds may change. Always verify current requirements through official state procurement portals before tendering.

Important: Most state thresholds exclude GST, while federal thresholds include it. This distinction catches out many businesses.

NSW Procurement Thresholds

What is the tender threshold for NSW government contracts? New South Wales requires competitive tendering for goods and services contracts valued at $250,000 or more (excluding GST). Construction contracts trigger tendering at $1 million.

NSW also enforces SME participation requirements for larger contracts. For procurements over $3 million, agencies must allocate a minimum percentage of non-price evaluation criteria to assess how suppliers will support small business participation.

Contracts exceeding $7.5 million require Aboriginal Participation Plans, with targets typically set at 1.5% of project value.

All NSW Government tenders are published on the buy.nsw portal.

Victorian Procurement Thresholds

Victoria takes a slightly different approach, emphasising procurement complexity alongside contract value.

The headline figures remain $250,000 for goods and services and $1 million for construction. However, Victoria’s framework allows agencies to consider market conditions and procurement risk when determining their approach.

From September 2024, suppliers tendering for Victorian Government contracts of $1 million or more must hold a Fair Jobs Code pre-assessment certificate. This confirms compliance with industrial relations and workplace safety laws over the preceding three years.

Tenders appear on the Buying for Victoria portal.

Queensland Procurement Thresholds

Queensland uses a category-based procurement system that considers complexity alongside value.

The standard thresholds align with other eastern states: $250,000 for goods and services, $1 million for construction.

Queensland’s framework groups procurements into four complexity categories, which can influence the approach even below threshold values. High-risk or complex purchases may warrant more rigorous processes regardless of dollar value.

Western Australia, South Australia & Other States

Western Australia matches the $250,000 goods and services threshold but sets construction higher at $2 million—double the eastern state standard.

South Australia stands out with the nation’s highest construction threshold at $9 million (excluding GST). This reflects the state’s approach to reducing tender costs for building projects. Goods and services sit slightly lower than elsewhere at $220,000.

Tasmania, Northern Territory, and ACT share similar construction thresholds of $1.5 million. However, the NT and ACT set goods and services thresholds significantly higher at $500,000—double most other jurisdictions.

Local Government (Council) Tender Thresholds

Do local councils have to tender? Yes, but under different rules than state and federal agencies.

Local councils operate under state-based Local Government Acts, not Commonwealth Procurement Rules or state procurement policies. This creates another layer of variation.

Most councils must call public tenders for contracts above a set threshold—typically around $250,000 in NSW. But exemptions exist, and some councils set lower thresholds in their own procurement policies.

NSW Local Council Thresholds

Under the Local Government Act 1993 (NSW), councils must invite tenders for contracts estimated to exceed $250,000 (including GST).

However, councils can bypass tendering when purchasing through “prescribed” organisations. Local Government Procurement (LGP) is one such body—councils using LGP contracts don’t need to run separate tenders, even for amounts above $250,000.

This explains why you might see some councils purchasing significant goods or services without a public tender process.

Victorian Local Council Thresholds

Victoria’s Local Government Act 2020 took a different path. Rather than setting fixed thresholds in legislation, it requires councils to adopt their own procurement policies.

These policies must:

- Promote open and fair competition

- Support value for money

- Consider opportunities for local suppliers

- Specify the council’s own thresholds and procurement methods

This means Victorian council thresholds vary. Some align with the $250,000 figure common elsewhere; others set different limits based on their risk appetite and purchasing patterns.

How to Find Your Council’s Threshold

Want to know a specific council’s threshold? Here’s what to do:

- Visit the council website — Look for “Procurement Policy” or “Purchasing Policy” under governance or corporate documents

- Check tender portals — Many councils use Tenderlink or VendorPanel; registration often reveals threshold information

- Phone the procurement team — Council staff can confirm current thresholds and upcoming opportunities

- Review annual reports — These sometimes include procurement policy summaries

Pro tip: Building relationships with council procurement officers often opens doors to below-threshold opportunities that never get publicly advertised.

What Happens Below the Tender Threshold?

Below the threshold, agencies have more flexibility. But “flexible” doesn’t mean “anything goes.”

What happens below the tender threshold? Government agencies can use simplified procurement methods including direct approaches, limited quotations, or purchases from existing panels. However, the November 2025 CPR changes introduced new rules prioritising Australian businesses for federal contracts below $125,000.

Common below-threshold methods include:

- Direct sourcing — Approaching a single supplier (usually for very low values or specialist requirements)

- Request for quotation (RFQ) — Seeking quotes from multiple suppliers, typically three or more

- Panel arrangements — Purchasing from pre-approved supplier lists

- Limited tender — Inviting selected suppliers to submit proposals

The key change from November 2025: federal agencies must now invite only Australian businesses to tender for non-panel procurements valued between $10,000 and $125,000.

This represents a major shift. Previously, the non-discrimination rule meant agencies couldn’t preference Australian suppliers. That rule now applies only to above-threshold procurement.

For Australian businesses, this opens significant opportunity. Based on 2024–25 data, approximately 31,000 federal contracts worth nearly $2 billion fall into this below-threshold category annually.

How to Calculate Procurement Value Against Thresholds

Getting the calculation wrong can have consequences. Underestimate, and you might miss tender requirements. Deliberately split contracts to avoid thresholds, and you risk serious compliance issues.

How are tender thresholds calculated? Contract value for threshold purposes includes the total expected expenditure over the entire contract term, including options, extensions, all fees, and GST (for federal procurement).

What to Include in Your Estimate

When estimating tender value, include:

- Base contract term — The initial period of the agreement

- Option periods — Any extension options, even if you don’t expect to exercise them

- All forms of payment — Fees, commissions, allowances, premiums

- Potential variations — Anticipated scope changes or additional work

- Related purchases — Similar goods or services you’ll buy during the period

The CPRs specifically state that where procurement value cannot be reliably estimated, it must be treated as above threshold.

GST: Inclusive or Exclusive?

This trips up many businesses.

Federal thresholds include GST. The $125,000 figure is GST-inclusive, as clarified in the November 2025 CPRs.

Most state thresholds exclude GST. When NSW says $250,000, they mean the ex-GST figure.

Always check the specific wording of each threshold. Getting this wrong by 10% could push you across (or under) the line.

Avoiding Contract Splitting

Deliberately splitting purchases to stay below thresholds is prohibited across all jurisdictions.

What counts as splitting? Examples include:

- Breaking one project into multiple smaller contracts

- Spreading purchases across financial years to reduce individual contract values

- Separating goods from related services to keep each under threshold

Agencies are required to aggregate related purchases when assessing threshold requirements. The “same commodities, services or technology to be made within the twelve-month period” must be considered together.

Consequences for improper splitting can include contract invalidity, supplier exclusion from future opportunities, and reputational damage.

Australian Business Priority Rules 2025

The November 2025 CPR changes fundamentally shift how the Commonwealth approaches local supplier preference.

Are Australian businesses given priority in government tenders? Yes, for federal contracts below the threshold. From November 2025, non-corporate Commonwealth entities must invite only Australian businesses to tender for non-panel procurements valued between $10,000 and the relevant threshold ($125,000 for non-construction).

This represents the first time in over two decades that Australian businesses receive explicit priority in Commonwealth procurement.

Who Qualifies as an “Australian Business”?

The CPRs now define “Australian business” with specific criteria. To qualify, a business must have:

- 50% or more Australian ownership OR be principally traded on an Australian equities market (ASX)

- Australian tax residency

- Principal place of business in Australia

All three conditions must be met.

Interestingly, New Zealand businesses also qualify as “Australian businesses” for below-threshold procurement. This reflects obligations under the Australia-New Zealand Closer Economic Relations Trade Agreement.

New Reporting Requirements

From 1 July 2026, federal agencies face new accountability measures.

When awarding contracts where the Australian business preference rules applied, agencies must report on AusTender why a contract was not awarded to an Australian or New Zealand business (if applicable).

This transparency requirement aims to ensure agencies genuinely prioritise local suppliers rather than finding workarounds.

Construction vs Non-Construction Thresholds

You’ve probably noticed construction thresholds sit dramatically higher than goods and services across every jurisdiction.

What are the construction tender thresholds? Federal construction procurement triggers Division 2 requirements at $7.5 million. State thresholds range from $1 million (NSW, VIC, QLD) to $9 million (SA).

Federal Construction Threshold ($7.5 Million)

The $7.5 million federal construction threshold has remained unchanged in the November 2025 reforms.

Why so high? Construction projects typically involve:

- Complex scoping and specification requirements

- Significant tender preparation costs for suppliers

- Longer evaluation periods

- Established industry practices for competitive tendering

Below $7.5 million, federal agencies can use limited approaches while still requiring appropriate competition for higher-value work.

Construction services under the CPRs include building works, civil engineering, installation, repair, and related project management services.

State Construction Thresholds

State construction thresholds show the widest variation of any category:

| Jurisdiction | Construction Threshold |

| NSW, VIC, QLD | $1 million |

| Tasmania | $1.5 million |

| NT, ACT | $1.5 million |

| Western Australia | $2 million |

| South Australia | $9 million |

South Australia’s $9 million threshold stands out dramatically. The rationale: reducing tender costs for an industry where preparing competitive submissions requires substantial investment.

For construction businesses, this means tendering requirements vary significantly depending on which government you’re targeting—even for identical project values.

Conclusion

Tender thresholds might seem like bureaucratic detail, but understanding them shapes your entire approach to government work.

The November 2025 federal reforms mark the most significant changes in two decades. Higher thresholds mean more simplified procurement. Australian business priority rules create new pathways for local suppliers. And clearer definitions reduce ambiguity around who qualifies.

For Australian businesses, the message is clear: government procurement is becoming more accessible, not less.

Whether you’re targeting federal departments, state agencies, or local councils, success starts with knowing the rules. Check the relevant thresholds, verify current requirements, and position your business to compete—both above and below the line.

The opportunities are there. Now you know where to find them.

Last updated: November 2025. Threshold values and procurement rules change periodically. Always verify current requirements through official government sources before tendering.

Frequently Asked Questions

What is the minimum tender threshold in Australia?

There’s no universal minimum. Federal goods and services sit at $125,000 (incl. GST). States typically range from $220,000 to $500,000 (ex GST). Local councils vary based on their policies. Construction thresholds are higher across all jurisdictions.

Can government agencies avoid tendering?

Yes, through legitimate exemptions. These include emergency purchases, sole-source requirements (where only one supplier can deliver), purchases from existing panels, and procurement through prescribed arrangements. However, agencies must document justification for using these exemptions.

What is the difference between a quote and a tender?

A quote (or quotation) is typically a simpler, faster process used for lower-value purchases. Tenders involve formal documentation, public advertising, structured evaluation criteria, and longer timeframes. Quotes might require a one-page response; tenders often demand comprehensive submissions addressing detailed selection criteria. Learn more about tender types and how they differ.

How long does a government tender process take?

Timeframes vary based on complexity and jurisdiction. Federal tenders above threshold must remain open for minimum periods (typically 25–45 days depending on circumstances). State and local processes vary. From tender close to contract award might take weeks to months, depending on evaluation complexity and approval requirements.

Do tender thresholds include GST?

It depends. Federal thresholds (Commonwealth Procurement Rules) include GST. Most state and territory thresholds exclude GST. Always verify the specific wording—this 10% difference can determine whether competitive tendering applies.