TL;DR

Australia has five main tender types (open, selective, negotiated, single-stage, two-stage) plus four request formats (RFT, RFQ, RFP, EOI). Open tenders offer maximum opportunity but face fierce competition. Selective tenders reward established players. Understanding each type helps you target winnable contracts through AusTender and state portals, with thresholds ranging from $10,000 to millions.

Key Takeaways

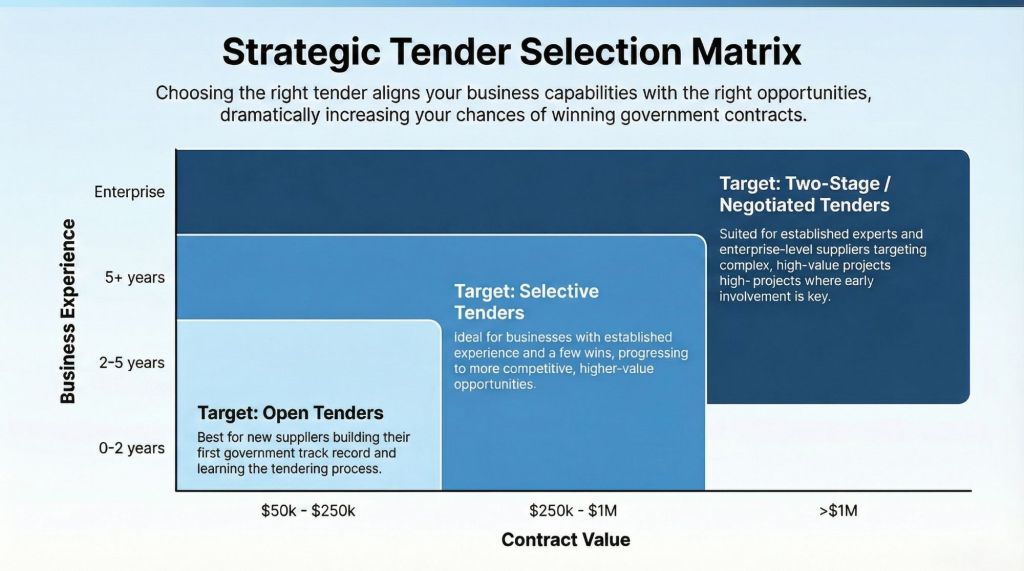

- Match tender type to business maturity: Open tenders for newbies, selective for established players, two-stage for technical experts

- Understand the process-request distinction: Process type (open/selective) determines competition; request type (RFT/RFQ) determines response format

- Build systematically: Start small with local open tenders, build track record, earn selective tender invitations

- Invest in relationships: Selective and negotiated tenders come from reputation, not just good submissions

- Resource appropriately: Open RFTs need 40-100 hours; simple RFQs need 2-20 hours—plan accordingly

Tenders are the backbone of how Australian governments buy goods and services, ensuring every contract is awarded fairly, transparently and with value for public money. Across federal, state and local levels, more than $80 billion is spent each year on procurement—creating opportunities for businesses in every industry, from construction and IT to professional services and healthcare.

Understanding how tender types work isn’t just technical knowledge. It directly affects which opportunities you can pursue, how competitive you’ll be, and how realistic your chances of winning are. Whether you’re browsing AusTender, Buy NSW, Tenders VIC or QTenders, knowing the difference between each tender type helps you focus on the opportunities that match your capability and resources.

What Are Tenders and Why They Matter in Australia

Tenders are formal procurement processes where government agencies and private organisations invite businesses to compete for contracts. They exist to ensure transparency, accountability and value for taxpayers—especially in high-spend, high-scrutiny sectors like construction, infrastructure, IT, education and healthcare.

For businesses, tenders open doors to stable revenue, long-term partnerships and stronger credibility. Even a single government contract can elevate your market position, build trust with future clients and drive opportunities that wouldn’t surface through private-sector work alone.

Because the rules are strict and the processes are designed for fairness, every business—whether new or established—has access to opportunities through platforms like AusTender, Buy NSW, Tenders VIC, QTenders and Tenders WA. The challenge isn’t finding tenders. It’s knowing which types you should pursue, and how they align with your capability, resources and growth plans.

Tender Types vs Request Types (The Key Distinction)

Before diving into the different tender types, it’s important to understand a distinction that often confuses new tenderers: tender process types and tender request types are not the same thing. They answer two very different questions.

Process types determine who can compete.

They shape the competitive environment — for example, whether a tender is open to everyone, limited to shortlisted suppliers, or negotiated directly with a single provider.

Request types determine what you respond to.

They define the structure and level of detail required in the documentation — for example, an RFT with full specifications, a simple RFQ, or an EOI used to shortlist suppliers.

The two can be combined in multiple ways.

An open tender might be issued as an RFT with detailed technical requirements, or as an RFQ for straightforward purchases. A selective tender may begin with an EOI before moving into a full RFP. In other words, the process type affects your competitiveness, while the request type affects the workload and format of your response.

Understanding the difference helps you plan your tendering strategy more effectively.

By identifying the process type, you gauge your likelihood of success. By recognising the request type, you understand the level of effort, expertise and resources required to submit a compliant response.

Tender Process Types (the 5 main types)

Now that the distinction between process types and request types is clear, we can break down the main tender process types used across Australian government procurement. Each one follows a different competitive structure, offers different advantages, and suits different stages of business maturity. Understanding these types will help you identify which opportunities are worth your time and which ones are unlikely to deliver a return on effort.

1. Open Tender (Public Tender)

Open tenders are publicly advertised opportunities that any qualified business can bid for. They’re mandatory above federal and state thresholds and appear on platforms like AusTender, Buy NSW, Tenders VIC and QTenders. They’re used when transparency and competition are essential.

When Open Tenders Are Commonly Used

- Road construction and maintenance

- IT system upgrades, software licences or equipment supply

- Facilities management for government buildings

- Professional services panels

- Vehicle and equipment purchases

Advantages

- Equal opportunity — no invitations or pre-qualification needed

- Clear evaluation criteria and transparent processes

- Suitable entry point for businesses new to government contracting

Challenges

- High competition (often dozens of bidders)

- Time-intensive responses for detailed RFTs

- Lower win rates without strong capability statements and past performance

Best For

- New suppliers building their first government track record

- Businesses targeting smaller contracts (around $50k–$250k) before progressing to selective tender lists

2. Selective Tender (Invited Tender)

Selective tenders are invitation-only opportunities. Buyers shortlist a small group of suppliers — usually 3 to 10 — based on capability, experience and past performance. Only those invited can submit a response.

How Shortlisting Usually Works:

- From previous contractor’s performance

- Through Expressions of Interest (EOIs)

- Via prequalification schemes (e.g., NSW SCM panels)

- Based on technical capability, licences and certifications

- Using compliance checks (insurance, safety systems, ISO standards)

Where Selective Tenders Are Common:

- Construction and civil engineering projects

- Complex IT implementations

- Healthcare equipment procurement

- Professional services (legal, architectural, consulting)

- Defence and security-related projects

Advantages

- Higher win rates (typically 15–30%)

- Smaller competitor pool — you’re bidding against 5–10 suppliers instead of 50+

- Buyers already recognise your capability

- More targeted, higher-value opportunities

Challenges

- Harder to break into without a track record

- Incumbent or panel suppliers often have a strong advantage

- Requires consistent performance on smaller projects first

- Building buyer relationships takes time

Best For:

- Businesses with established experience

- Suppliers progressing from open tenders to more competitive, higher-value opportunities

- Companies already on government or industry prequalification panels

3. Negotiated Tender (Direct Tender)

Negotiated tenders involve a buyer approaching a single supplier directly rather than running a competitive process. They’re rare in government procurement but more common in the private sector.

When Governments Are Allowed to Use Negotiated Tenders:

- Emergencies that require immediate action (e.g., natural disasters, critical infrastructure failures, cybersecurity breaches)

- Only one capable supplier exists (e.g., proprietary systems, patented technologies, exclusive distributors)

- Previous competitive tenders failed (no conforming bids or no suitable suppliers)

- Contract extensions needed for continuity (usually capped by value or duration)

Common Private-Sector Uses

- Urgent work requiring trusted partners

- Specialist services with limited competition

- Relationship-based procurement for long-term suppliers

Advantages

- No direct competition

- Faster procurement timelines

- Flexibility to negotiate scope, pricing and delivery

- Suitable for highly specialised or urgent requirements

Challenges

- Rare — not a reliable business development strategy

- Strict government limitations

- Often only available to suppliers with niche capability, strong reputation or previous contracts

- High dependency on buyer trust

Best For

- Established suppliers with proven expertise

- Businesses offering unique, proprietary or highly specialised services

- Contractors frequently engaged in urgent or emergency response work

4. Single-Stage Tender

Single-stage tenders involve one submission, one evaluation and one decision. Buyers provide complete specifications upfront, and suppliers submit a full response covering methodology, pricing and compliance in a single package.

When Single-Stage Tenders Are Used:

- Projects with clear, well-defined scopes

- Procurement where design and requirements are already final

- Situations where buyers want a straightforward, competitive comparison

Typical Contract Values:

- Under $100k: office equipment, IT hardware, routine services

- $100k–$500k: building fitouts, standard construction works, professional services

- $500k+: maintenance contracts, long-term service agreements

Advantages:

- Simple and predictable process

- Only one submission to prepare

- Clear timelines (usually 4–6 weeks to prepare, 2–4 weeks evaluation)

- Less risk of scope creep because requirements are fixed upfront

Challenges:

- No room for collaboration or design input

- Any missing detail in the buyer’s specs can create variation risks later

- Tenderers must fully price the project without discussion

- Risk of over-pricing or under-pricing due to lack of early engagement

Best For

- Suppliers confident in delivering well-defined scopes

- Businesses with strong estimating and documentation skills

- Projects that don’t require design input or early contractor involvement

5. Two-Stage Tender (Early Contractor Involvement / Multi-Phase)

Two-stage tenders bring suppliers into the project early, before the final scope is locked in. Buyers engage a contractor during design development (Stage 1), then request full pricing once the scope is refined (Stage 2).

How the Two-Stage Process Works:

Stage 1: Early Involvement

- Contractor joins the design team

- Provides buildability advice and construction methodology

- Helps identify risks and cost savings

- Offers indicative pricing and program input

- May receive a consultancy fee or work at risk

Stage 2: Formal Tendering

- Contractor submits detailed pricing on the finalised design

- Buyer may still reopen competition if Stage 2 pricing isn’t satisfactory

- Early involvement gives the Stage 1 contractor a competitive advantage

When Two-Stage Tenders Are Used

- Complex construction or infrastructure projects

- Projects where design and delivery need tight coordination

- Situations where buyers want cost certainty before committing

- High-value builds with significant risk or technical complexity

Advantages

- Contractor influences design, reducing variations later

- Better collaboration between buyer, designers and builder

- Improved cost accuracy and risk management

- Strong relationship building before the competitive stage

Challenges

- No guaranteed contract after Stage 1

- High resource investment over several months

- Sharing methodology and innovations before contract award

- Total process can run 6–12 months, tying up key personnel

Best For

- Businesses with strong technical expertise

- Contractors experienced in design development and value engineering

- Suppliers who benefit from early engagement and collaboration

Request & Solicitation Types

These request types tell you what format the buyer expects, how much detail is required, and how much work each response will take. They don’t decide who can compete — they shape how you respond.

Understanding these formats helps you plan your time, allocate resources and decide whether an opportunity is worth pursuing.

1. Request for Tender (RFT)

An RFT is the most detailed and formal type of request. Buyers already know exactly what they want and provide full specifications, drawings and contract conditions. Your job is to show you can deliver precisely what’s required — with a clear methodology, accurate pricing and full compliance.

What an RFT usually includes

- Detailed technical specifications and drawings

- Contract terms and conditions

- Insurance, safety and licence requirements

- Pricing schedules

- Evaluation criteria

Because everything is defined upfront, RFTs require the most work. You’re expected to provide a comprehensive, structured response that addresses methodology, risk, personnel, timelines and pricing.

When an RFT is used

Buyers use RFTs for major procurements or construction projects where the scope is clear and they want comparable, like-for-like pricing.

2. Request for Quotation (RFQ)

An RFQ is much simpler. It’s used when the buyer is purchasing standardised products or routine services where methodology doesn’t vary much. Instead of asking how you’ll deliver, the buyer mainly wants to know your price.

Typical RFQ uses:

- IT hardware

- Equipment supply

- Vehicles

- Routine maintenance

- Small to mid-value purchases (usually under $250k)

RFQs are fast to prepare — often just a pricing schedule and basic compliance documents — and usually have short turnaround times (1–2 weeks).

3. Request for Proposal (RFP)

An RFP focuses on the solution, not just the price. Buyers explain their objective, the problem they want solved, or the outcome they’re aiming for — and you propose the best approach.

This gives suppliers room to demonstrate expertise, innovation and value beyond basic compliance.

What buyers look for

- Your overall approach

- How you’ll deliver outcomes

- What makes your method more effective

- Risks and how you’ll manage them

- Any value-adds or innovative ideas

RFPs suit projects where buyers want to compare thinking, capability and methodology — not simply who is cheapest.

4. Expression of Interest (EOI)

An EOI is a preliminary step used to understand who in the market is capable of delivering the work. It helps buyers refine their procurement approach, shortlist suppliers, or assess capability before releasing a formal tender.

What an EOI usually asks for

- Company background and capability

- Relevant projects

- Key people

- Financial capacity

- High-level methodology

- (Sometimes) indicative pricing

You’re not trying to win the contract here — you’re trying to earn a place on the shortlist.

5. Request for Information (RFI)

An RFI is purely exploratory. Buyers use it to research the market, understand available solutions, gather pricing ranges or test ideas before finalising their procurement strategy.

No contract comes directly from an RFI — but responding positions you early and may help shape the future tender.

Why RFIs matter

- You learn the buyer’s challenges early

- You can influence the direction of the upcoming tender

- You build visibility before formal procurement begins

Which Tender Type Should You Target?

Choosing the right tender type is just as important as preparing a strong submission. Not every opportunity is suitable for every business, and spreading yourself too thin can damage both your win rate and your confidence. The goal is to focus on the types of tenders that match your capability, resources and experience — not simply chase everything that appears online.

The most practical way to decide what to target is to look at your current business stage and work backwards from there.

If You’re New to Government Contracting (0–2 years)

At this stage, the priority is building experience and learning the tendering process without overcommitting.

Best suited to:

- Smaller open tenders (around $50k–$250k)

- RFQs for standardised or routine services

- EOIs to get onto buyers’ radar, even if you don’t win immediately

Open tenders can be competitive, but they’re accessible and help you gain practical experience. Smaller opportunities are more realistic wins and allow you to refine your internal tendering process.

Avoid two-stage tenders for now — they require heavy involvement and significant resources without guaranteed payoff.

If You’re Building Your Reputation (2–5 years, 5–20 completed government contracts)

Once you have a few wins behind you, you can start targeting more selective opportunities.

Best suited to:

- Selective tenders, especially if you’ve joined prequalification schemes

- Medium-value contracts ($250k–$1M)

- EOIs that lead directly to shortlist invitations

- Two-stage tenders only when your technical capability adds genuine value

By this point, buyers take your experience seriously, making it easier to earn invitations. Your responses should now focus on demonstrating outcomes, capability and track record.

If You’re an Established Supplier (5+ years, 20+ government contracts)

With strong past performance, you can confidently target higher-value opportunities and more complex procurement approaches.

Best suited to:

- Selective tenders with higher contract values

- Two-stage tenders where your expertise strengthens the design stage

- Opportunities over $1M where your capability stands out

- Occasional negotiated tenders, especially if you offer unique or specialised services

This stage is about choosing tenders strategically — less volume, more precision. Win rates tend to improve as buyers recognise your name and previous performance.

If You’re Operating at Enterprise Level

Large suppliers with significant market presence often focus on major or complex projects.

Best suited to:

- Selective tenders with high-value, long-term contracts

- Two-stage tenders for major construction or infrastructure projects

- Multi-disciplinary or consortium-led opportunities

- Negotiated tenders where unique capability or IP sets you apart

You’re no longer competing widely — you’re choosing where you can deliver the highest value and maintain strong relationships with government buyers.

Conclusion

Understanding tender types helps you make clearer, more strategic decisions. Each process type sets different expectations, shapes competition and affects how much effort a response will require. When you know how these tenders work, you can focus on opportunities that suit your capability, avoid unnecessary workload and steadily build a solid track record in the government market.

A targeted approach always outperforms chasing everything. Choose the tenders that align with your strengths, invest where you can deliver real value and build momentum through consistent, well-planned submissions.

What insurance do I need for government tenders?

Most government tenders require $10–$20 million public liability insurance and relevant professional indemnity coverage. Construction projects may also require contract works or workers compensation insurance depending on the scope.

Can international companies bid on Australian tenders?

Yes — but they must hold an ABN, meet Australian compliance requirements, and be able to deliver services to local standards. A local presence often improves competitiveness.

How much time should I allocate to preparing a tender response?

It depends on the request type:

-RFQs: 2–20 hours

-Standard RFTs: 40–80 hours

-Complex or high-value tenders: 80–200+ hours

Planning ahead is essential, as many submissions require input from multiple team members.

What are typical tender success rates?

Success rates vary by process type:

-Open tenders: 3–8%

-Selective tenders: 15–30%

-Two-stage tenders: up to 70–80% if Stage 1 involvement is strong

Tracking your win rate helps you refine your strategy over time.

Should I use a tender consultant?

A consultant can be helpful for high-value or business-critical opportunities where expertise significantly improves your competitiveness. For routine tenders, many businesses prefer building internal capability.